The demand outlook for global banking-as-a-service (BaaS) platform market remains impressive as Future Market Insights (FMI) forecasts sales to surpass US$ 12.2 Bn by the end of 2031.

The demand outlook for global banking-as-a-service (BaaS) platform market remains impressive as Future Market Insights (FMI) forecasts sales to surpass US$ 12.2 Bn by the end of 2031.

The market is expected to register impressive growth as the adoption of BaaS platform surges within fintech corporations. As per the study, the global BaaS platform market is poised to expand at 15.7% CAGR between 2021 and 2031.

With increasing adoption of digital banking services across several domains, demand for BaaS platform has surged in medium and small sized organizations. Integration of artificial intelligence, block-chain technology, and API services within internet banking also will boost the demand.

Several banks and financial institutions are investing in digital transformation to offer tech savvy banking operations. Large organizations are increasing the adoption of BaaS platform to enhance their customer base.

Driven by the outbreak of COVID-19, various organizations are revamping their businesses by implementing digital banking services. Hence, adoption of BaaS platforms witnessed a sudden spike as organizations raced to deliver outstanding digital experience to their customers.

Request a report sample to gain comprehensive insights at https://www.futuremarketinsights.com/reports/sample/rep-gb-13992

Adoption of BaaS platform within fintech corporations increased at a remarkable pace. Increasing reliance on mobile banking, digital payments, and net-banking among consumers also has aided the market growth.

“Rapid proliferation of work-from-home and increasing reliance on digital payments and online banking is encouraging key players to implement block-chain and artificial intelligence technology to deliver secure services to the customers. This is amplifying sales in the market,” says the FMI analyst.

Key Takeaways from FMI’s Banking-as-a-Service Platform Market Survey

- In terms of solution, BaaS APIs segment will witness growth at a robust 17% CAGR during the forecast period

- Banking as service platform will account for the leading market share and continue to retain its dominance through 2031

- Large organizations will account for half of global banking-as-a-service market sales

- In terms of enterprise size, mid and small-sized organizations segment will register remarkable growth at 16.6% CAGR

- Fintech corporations are expected to be the leading end-users of BaaS platforms, accounting for a share of nearly 26%

- The U.K. market will register highest sales across Europe, accounting for nearly 29% of market share

- Demand for banking-as-a-service platform across the U.S. is set to rise at an impressive 15% CAGR

- India banking-as-a-service platform market will register staggering growth at 26% CAGR owing to the flourishing fintech companies in the country

View Full Report at: https://www.futuremarketinsights.com/reports/banking-as-a-service-baas-platform-market

Key Drivers

- Adoption of BaaS platform among diverse end users such as clothing industry, online retailers, and others will increase as they aim for expanding their customer base

- Surging collaboration between incumbents and fintech innovators to distribute financial products and gain remunerative opportunities will boost the market

- As BaaS platform reduces digitization costs for incumbents, more fintech companies are adopting these services to gain edge in the industry

Key Restraints:

- Lack of protection of secure data and flexibility will act as challenge for banking-as-a-service providers

- Unavailability of secure platforms to deploy targeted solutions might hamper the market growth

Competitive Landscape

Leading players in the market are focusing on acquiring fintech start-ups to develop their own net-banking and digital banking products to reduce their churn rates. Also, the players are coming up innovative solutions to serve their customers.

Rapidly changing demand from various organizations for advanced banking products and digitalization is encouraging leading players to rely on third parties and develop new APIs services.

For instance,

- In September 2021, Monese, the leading European fintech announced the launch of banking-as-a-service platform and new partnership with Investec Bank Plc.

- Temenos, the banking software company, on September 26, 2021, announced its strategic collaboration with Vodeno, a fully cloud-native BaaS provider and Aion Bank, a European licensed digital bank to accelerate banking as a service deployment in Europe.

- In July 2021, Cermati Fintech Group launched its BaaS technology platform product in Indonesia through a strategic partnership with BCA Digital, a leading bank in Indonesia and Blibli.

Some of the key players operating in the banking-as-a-service platform industry market profiled by FMI are:

- Sopra Banking Software

- Solarisbank AG

- Bankable

- Treezor

- 11:FS Foundry

- Clearbank Ltd.

- Q2 Software, Inc.

- Green Dot Corporation

- Sterling National Bank

- Banco Bilbao Vizcaya Argentaria (BBVA), S.A

- Unit Finance Inc.

- Starling Bank

- Treasury Prime

- ADVAPAY OÜ

- Technisys.

- Others

Buy The Report: https://www.futuremarketinsights.com/checkout/13992

More Valuable Insights on Banking-as-a-Service Platform Market

Future Market Insights, in its new offering, presents an unbiased analysis of the banking-as-a-service market. The study delivers essential insights on the banking-as-a-service market on the basis of:

By Solution:

- Banking as a Service Platform

- Banking as a Service APIs

- Services

- Payment Processing Services

- Digital Banking Services

- KYC Services

- Customer Support Services

- Others

By Enterprise Size:

- Small & Mid-Sized Organizations

- Large Organizations

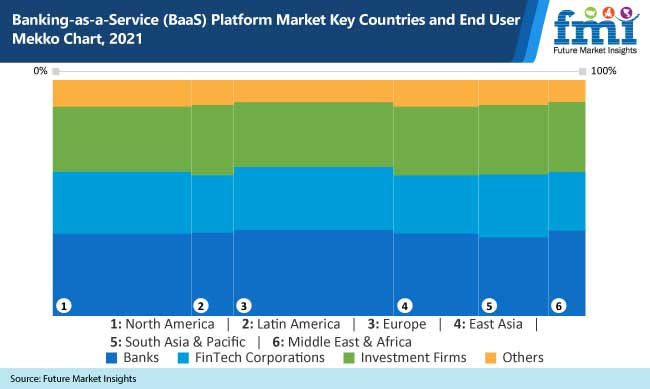

By End User:

- Banks

- FinTech Corporations

- Investment Firms

- Others

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East and Africa

Key Questions Covered in the Report

- The report offers insight into banking-as-a-service platform market demand outlook for the forecast period 2021-2031

- The market study also highlights projected sales growth for banking-as-a-service platform market between 2021 and 2031

- Banking-as-a-service platform market survey identifies key growth drivers, restraints, and other forces impacting prevailing trends and evaluation of current market size and forecast and technological advancements within the industry

- Banking-as-a-service market platform share analysis, covering key companies within the industry and coverage of strategies such as mergers & acquisitions, joint ventures, collaborations or partnerships, and others