Linerless labels are designed without a release liner, which reduces the amount of raw material required to manufacture labels, and makes these labels an eco-friendly alternative. Absence of a liner layer saves on extra labor, storage, and transportation costs for end users, and reduces industrial waste and carbon emission. These factors are expected to boost the demand for linerless labels substantially during the forecast period (2019-2029).

Removable linerless labels are estimated to hold a leading position in the global linerless labels market, and generate an incremental opportunity of US$ 240 Mn from 2019-2024. Prominent packaging manufacturers are continuously striving to offer sustainable and environment-friendly packaging solutions to various end-use industries.

For more insights into the market, request a sample of this report@ https://www.futuremarketinsights.com/reports/sample/rep-gb-1822

Key Takeaways of Linerless Labels Market Study

- Consistent growth of the logistics sector across all geographies, coupled with high requirement of linerless labels for inventory management, asset tracking, and goods distribution, is steadily driving the linerless labels market.

- The retail industry is a prominent end user of linerless labels, owing to rising efforts across the world to reduce the incidence of counterfeiting.

- North America and APEJ are expected to account for a major portion of the linerless labels market share. Rapid expansion of pharmaceutical and food & beverage industries is boosting the growth of the linerless labels market in these regions.

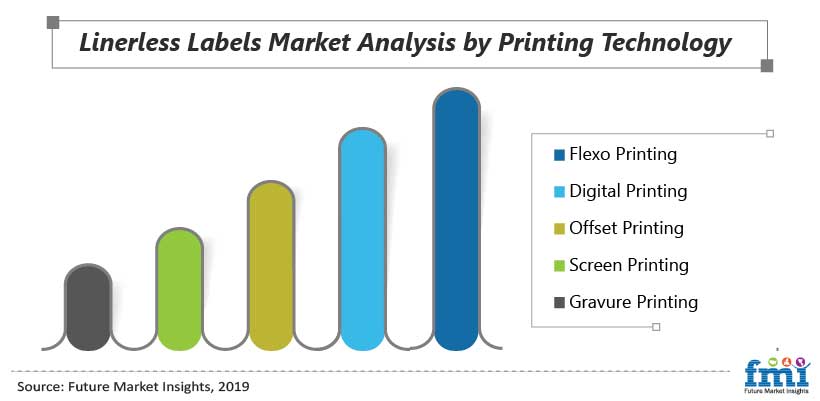

- Digital printing and flexo printing are projected to dominate the global linerless labels market, and hold nearly half of the market share by the end of 2029.

Manufacturers of linerless labels can gain substantial profits by focusing on the Asia Pacific excluding Japan region, attributable to rising demand for packaging solutions due to the rapidly growing food & beverage industry in this region.

Increasing Production Capacity and Acquisitions to Remain Key Growth Strategies

Prominent packaging manufacturers across the world have already shifted their focus from conventional packaging solutions to environment-friendly packaging solutions. This shift is majorly driven by increasing focus towards reducing waste, and high consumer preference towards highly sustainable and eco-friendly packaging solutions. Leading manufacturers are striving to maximize their manufacturing capacities to meet the rising demand for eco-friendly packaging solutions. Additionally, leading linerless label manufacturers are expanding business boundaries to reinforce their market position.

- In June 2019, RR Donnelley & Sons Company, one of the leading manufacturers of linerless labels, expanded its liners less labels manufacturing platform by adding a new linerless press. This enabled the company to expand its linerless label production to provide innovative linerless labels and enhance operational effectiveness.

- In July 2019, Coveris completed its acquisition of Amberley Labels, a U.K.-based manufacturer of high quality self-adhesive labels.

- In February 2017, CCL industries completed the acquisition of Innovia Group, a prominent producer of linerless labels and packaging solutions, for around US$ 1.13 billion.

For Information On The Research Approach Used In The Report, Ask Analyst @ https://www.futuremarketinsights.com/ask-question/rep-gb-1822

About the Linerless Labels Market Report

Future Market Insights, in its new offering, offers an unbiased analysis of the global linerless labels market, analyzing historical demand from 2014-2018 and forecast statistics for 2019-2029. The study unravels growth projections on the linerless labels market on the basis of product type (variable imaged and direct thermal), printing technology (digital printing, flexo printing, offset printing, gravure printing, screen printing, and others), adhesion (permanent, removable, and repositionable), and end-use industry (retail, food & beverages, logistics, pharmaceuticals, and others), across seven major regions