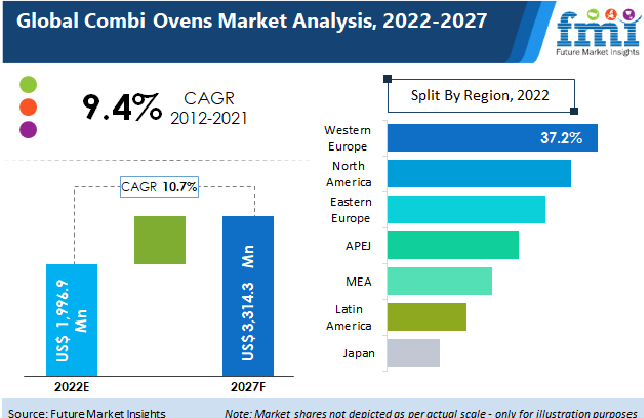

A new report published by Future Market Insights (FMI) titled “Combi Ovens Market: Global Industry Analysis (2013-2021) and Opportunity Assessment (2022-2028)” states that the demand for combi ovens across the globe highly depends upon the food preferences in different countries. For instance, people in China and the U.S. majorly consume fried items, whereas people in Europe make bakery, fried, and roast as their preference. The growing demand for combi ovens has impelled manufacturers to approach the market in accordance to the strong demand for heavy and medium capacity combi ovens in order to serve hotels, institutions, and commercial kitchens. According to FMI, the global combi ovens market is anticipated to witness a CAGR of 10.3% over the course of the forecast period.

- To Get a Sample Copy of the Report visit @ https://www.futuremarketinsights.com/reports/sample/rep-gb-6377

2012-2021 Global Combi Ovens Market Outlook Compared to 2022-2027 Forecast

Combi Ovens are meant to do a range of tasks including baking, roasting, broiling and steaming. It is becoming more popular for preparing continental cuisine. Combi Ovens are becoming a popular alternative to traditional foodservice equipment due to their features and high utility. Electric Combi Ovens are also becoming more popular in high-altitude settings.

As a result, their demand is expected to skyrocket in the future years. Furthermore, the ability to self-clean is the most significant characteristic of a combi oven, which makes it a popular choice.

The majority of combi ovens offer self-cleaning systems that use either tablets or liquid detergents. As a result, maintenance time and cost are significantly reduced. This is expected to shoot up the demand for combi ovens in will help to augment supply.

Request Complete TOC Of this Report @ https://www.futuremarketinsights.com/toc/rep-gb-6377

North America to Oust Europe in Terms of Value Share by the End of 2028Among all the regions, Western Europe is expected to emerge as the leading region in the global combi ovens market with a share of 41% in 2017. However, by the end of the forecast period, Western and Eastern Europe are both likely to witness decline in their market shares and North America will witness a substantial rise in its share in the overall market by the end of 2027. The growth of North America can be attributed to the growing investments being done by leading market players. To expand their market presence and global footprint, numerous players are focusing on investing in the North America market. Key players are adopting the strategy of mergers and acquisitions to collaborate with the local emerging players and to penetrate into the North America and strengthen their sales channel distribution.

Enhancement of Product Portfolio to be Core Strategy of Key Market PlayersKey market participants are focusing on enhancement of their medium-term expansion strategy, product portfolio strategy, and mergers with regional distributors to expand their business. The players operating in the market are Alto-Shaam Inc., Electrolux AB, Fujimak Corporation, The Middleby Corporation, Retigo S.R.O, and Dover Corporation, among others.

Global Combi Ovens Market by CategoryBy Product Type, the Global Combi Ovens Market is segmented as:

- Steam Generated

- Boilerless

By Power Unit, the Global Combi Ovens Market is segmented as:

- Gas

- Electric

By Capacity, the Global Combi Ovens Market is segmented as:

- Low

- Medium

- Heavy

By End-use, the Global Combi Ovens Market is segmented as:

- Hotels & Restaurants

- Bakery Stores

- Retail Outlets

- Domestic & Institutional

- Commercial Kitchens

By Region, the Global Combi Ovens Market is segmented as:

- North America

- Latin America

- Western Europe

- Eastern Europe

- APEJ

- Japan

- Middle East & Africa