Future Market Insights, an ESOMAR-certified Market Research Company, in its newest study on the chopper pumps market, opines that the market is slated to surpass US$ 1.20 Bn by 2030. Chopper pump manufacturers are ramping up efforts to increase pumping efficiency of chopper pumps. FMI’s analysis estimates that efficiency increase by a mere 2%-3% would incur costs savings to the tune of thousands of dollars every year.

In countries such as the US, approximately 15%-20% of chopper pumps are energy-efficient, thus boosting market prospects through 2030. This has also paved way for increased R&D spending wherein manufacturers are focusing on development of innovative chopper pump solutions with high durability and increased efficiency.

- To Get a Sample Copy of the Report visit @ https://www.futuremarketinsights.com/reports/sample/rep-gb-11722

Chopper Pumps Gaining Ground in Municipal Applications

The labelling of hygiene products as ‘flushable’ has led to severe clogging problems in sewage and wastewater treatment plants. Slated to account for 22% of the market share in 2020, the municipal application segment of chopper pumps market will witness high value and volume growth through 2030.

Chopper pumps help cut down rags and solids in wastewater and sewage plants. While many of these pumps are found in wastewater treatment plants, facilities such as hotels rely on these pumps to pump and move the sewage to a distant tank.

Similarly, any facility located at a height below the septic tank will need a pump to pump up the mud and slurry and transport it to its intended destination.

Another tangible plus point of chopper pumps is their use in manure slurries which yield good quantities of fertilizers that can be used for a host of agricultural applications. Use of chopper pumps for agricultural applications are poised to capture one-fourth of the chopper pumps market.

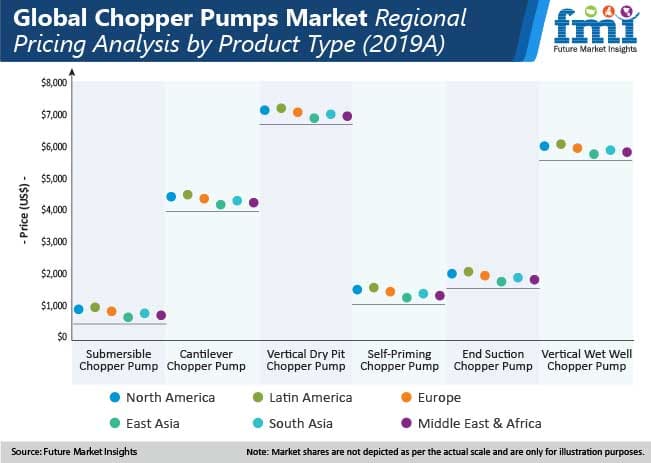

Chopper Pumps Market – Regional Analysis

Request Complete TOC Of this Report @ https://www.futuremarketinsights.com/toc/rep-gb-11722

Key Takeaways of Chopper Pumps Market Study

- Superior durability, higher product lifecycles and reduced installation costs will be primary USPs of chopper pump manufacturers

- Organized aftermarket services and a robust network of distributorships for maintenance services will brighten prospects for chopper pumps market through 2030

- Cost saving processing in food and beverages sector is anticipated to create new investment streams for chopper pumps in developing regions such as China and India

- Strong branding and brand positioning by SME’s and small-scale retailers of chopper pumps is enabling penetration of local players in the market

COVID-19 Impact on Chopper Pumps Market

Manufacturers are seeing their revenue pools shrink with large scale disruptions in supply chains due to quarantines and factory shutdowns.

Sectors such as chemicals, paper and pulp, wastewater management and agriculture are seeing a slowdown in new project developments and is impacting overall demand for pumps.

The near-term impact on chopper pumps market will be determined by effective management of supply chains and fiscal/control measures for continued liquidity for SMEs. Post pandemic, it is anticipated that chopper pump manufacturers will re-shore their manufacturing and facilities towards South Asia in countries such as India. With agriculture and food processing relatively less affected by the pandemic, the market will recover in the foreseeable future

Chopper Pumps Market Competition Landscape

The market for chopper pumps is fairly fragmented. The leading stakeholders have a large footprint in regions such as North America and Europe.

On the other hand, smaller players are penetrating extensively in developing regions of Asia Pacific where they are expanding their local networks by either setting up their own sales and distribution channels or collaborating with independent distributors.

- Sulzer, a Switzerland based pump manufacturer, has introduced dewatering submersible chopper pumps with an equipped aquatronic unit giving real time intelligence

- Vaughan Co, a US based pumps supplier, has launched more than 2o patents for its range of innovative products

- Cornell Pump Company, another US based pump manufacturer, accounted for 2.4% of the market share in 2019. It extensively brands its pumps by participating in trade shows and events across the world

- The Danish Water Technology alliance between the Danish water sector and North America is projected to create numerous opportunities for Landia, a Denmark based pump manufacturer. The company actively strives for new and innovative chopper pumps to achieve lowest lifespan costs with minimal resource consumption

Market Taxonomy

Product Type

- Submersible Chopper Pump

- Cantilever Chopper Pump

- Vertical Dry Pit Chopper Pump

- Self-Priming Chopper Pump

- End Suction Chopper Pump

- Vertical Wet Well Chopper Pump

Outlet Diameter

- Up to 50 mm

- 50 – 100 mm

- 100 – 150 mm

- Above 150 mm

Application

- Agriculture

- Municipal

- Water Treatment

- Sewage Treatment

- Automotive

- Steel

- Chemical & Petrochemical

- Food Processing

- Mining

- Paper & Pulp

Region

- North America

- Latin America

- Europe

- East Asia

- South Asia Pacific

- Middle East & Africa (MEA)