FMI, in its upcoming business report, elaborates the historical and current scenario of the Direct Reduced Iron (DRI) Market in terms of production, consumption, volume, and value. The report scrutinizes the market into various segments, regions, and players on the basis of demand patterns and growth prospects.

Direct reduced iron (DRI) has recently emerged as a quality supplement, in place of scrap steel, among steel-making companies. Increasing steel production capacities heightened awareness about CO2 emission control among steel producers, and accelerating demand for high-quality steel from end-users continues to drive DRI consumption in the global market. According to a recent report published by Future Market Insights (FMI), the global DRI market is projected to reach revenues worth US$ 17 Bn by 2030 end, with growth projected at an impressive CAGR between 2020 and 2030.

Request Sample Copy of this Report @ https://www.futuremarketinsights.com/reports/sample/rep-gb-11635

While increasing steel production capacities in China, India and some Middle Eastern countries account for the amplifying DRI demand, the COVID-19 pandemic has led to disruptions across end-use industries, thereby impeding demand for steel. Ban on steel scrap imports is significantly steering sales of DRI amid the global coronavirus outbreak. Surplus supply, and low demand and high storage volumes will result in considerably falling steel production in the near term, ultimately affecting the demand for DRI. Pet dietary

Key Takeaways from DRI Market Study

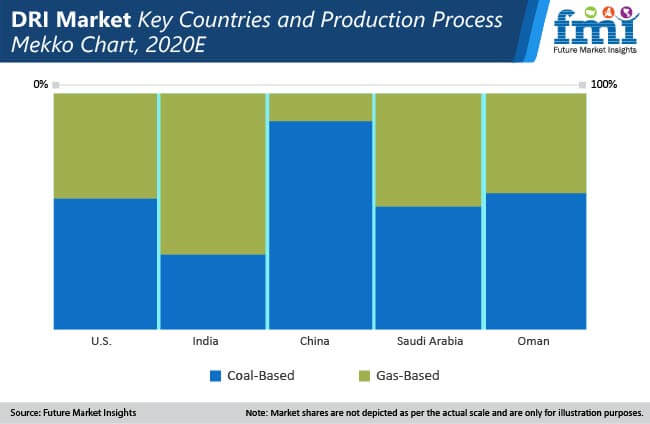

The gas-based production process to remain as the go-to option among manufacturers, especially in North America, Europe, and the Middle East, due to lower natural gas prices

Coal-based production is dominated by India, which accounts for almost 80% of the DRI produced through a coal-based process

Pellets are the most preferred among DRI form types, as they are easy to transport, have better reactivity, and are cost-effective than lumps

Over the recent past, DRI imports have been witnessing a steady rise despite facing stern competition from hot briquetted iron (HBI); the latter has low reactivity and is subject to lower transportation costs

Vertical integration strategies adopted by steel manufacturers to produce DRI at their own facilities would remain an impending trend in the near future

DRI Market: Key Participant Insights

While DRI will not replace scrap steel as the primary raw material for steel production, it is projected to be utilized as a key ingredient and in higher proportions. In addition, the growing demand for high-quality steel products is further expected to drive DRI demand. Most of the leading tier-1 manufacturers in the DRI market, like ArcelorMittal, SIDOR, Jindal Steel, Mobarakeh Steel, and Nucor, use most of their production for captive consumption and the rest for exports to major steel manufacturers around the world. Capacity expansions are also one of the primary focuses of the globally leading manufacturers to stay ahead of the competition.

For More Details, Ask Analyst @

https://www.futuremarketinsights.com/ask-question/rep-gb-11635

Direct Reduced Iron (DRI) Market: Segmentation

Production Process

- Coal-based

- Gas-based

Application

- Steel Production

- Construction

Form

- Lumps

- Pellets

Contact Sales for Further Assistance in Purchasing this Report@ https://www.futuremarketinsights.com/checkout/11635

Region

- North America

- Latin America

- Europe

- South Asia and Pacific

- East Asia

- Middle East and Africa

Leading Suppliers in DRI Market

While the DRI market landscape is currently controlled by a number of existing players, the near future is more likely to witness the emergence of new steel manufacturers that are currently investing in vertical integration of their businesses. Banking on the ability to satisfy their own demand, and backed by consistently falling raw material procurement costs, DRI manufacturers are witnessing promising growth avenues, especially in the Middle East. Some of the key players in the global DRI market include,

Americas

- ArcelorMittal

- Ferrominera Orinoco (FMO)

- Venezolana de Prerreducidos Caroní C.A. (Venprecar)

- NUCOR

Europe & Middle East

- Mobarakeh Steel Company

- Khouzestan Steel Company

- Tosyal? Holding

- METALLOINVEST MC LLC

Asia Pacific

- JSW

- AM/NS India

- Tuwairqi Steel Mills