Globally, the market for mobile payment transactions is projected to increase through 2020 at a CAGR of 23.2%, taking into account the number of users. Eastern Europe is predicted to have a small user base but is expected to increase rapidly—by 29.1 percent—during the projection period. In 2014. In 2014, APAC had the highest percentage of mobile payment system users, and it is predicted that this trend will continue through 2020, expanding at a CAGR of 22%.

According to FMI, the proliferation of mobile devices and increasing adoption of mobile money services across financial institutions and other vendors are the key factors driving the mobile payment transaction services market. Merchants and vendors around the world are upgrading their POS systems to facilitate mobile payment, and FMI expects this trend to continue during the forecast period.

Key factors that can impede the growth of the mobile payment transaction services market include issues with data security and privacy, and limited awareness among consumers. FMI estimates these factors to have a moderate impact on the mobile payment transaction services market growth.

Request a Sample Report with Table of Contents and Figures@

https://www.futuremarketinsights.com/reports/sample/rep-gb-262

On the basis of key applications, FMI has segmented the mobile payment transaction services market into money transfer, merchandise purchase, airtime top-ups, bill payment, ticketing, and ‘others’.

Globally, considering the number of users, mobile payment transactions market is anticipated to grow at a CAGR of 23.2% through 2020. Eastern Europe is estimated to hold a small portion of user base however is set to witness a high growth rate of 29.1% through the forecast period. In 2014. APAC held maximum number of mobile payment system users in 2014, and is estimated to continue the same trend growing a CAGR of 22% through 2020.

The mobile payments market was valued at US$ 392 billion in 2014 and is expected to reach the US $ 2849 billion by 2020. Growing at a CAGR of 39.2% over the forecast period. The growth of the mobile payment market is mainly attributed to the growing ubiquity of mobile phones and their increasing features replacing the physical wallet. Additionally, consumers are increasingly getting comfortable with using their smartphones for applications other than voice.

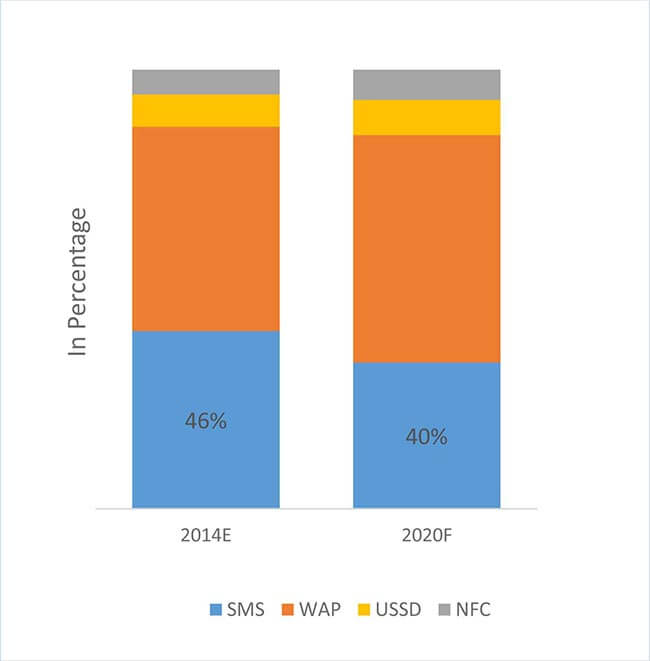

Technology-wise WAP/WEB is anticipated to hold more than 40% of the total market share followed by SMS. However, NFC communication is set to grow with a high growth rate of approximately 46% through 2020.

Our advisory services are aimed at helping you with specific, customized insights that are relevant to your specific challenges. Let us know about your challenges and our trusted advisors will connect with you@

https://www.futuremarketinsights.com/askus/rep-gb-262

Africa and Asia Pacific are the two most lucrative regions for mobile payment transaction services market. In terms of value, these two regions collectively accounted for nearly 58% share of the global market in 2014. FMI forecasts that these two regions will continue to dominate the global market during the forecast period.

A key development in the global mobile payment transaction services market is that Asia Pacific will outpace Africa to become the largest market. FMI estimates Asia Pacific mobile payment transaction services market to account for 27% of the global mobile payment transaction service market revenue by 2020.

Among all the regions, North America is poised to witness the significant growth. North America held a 22.8% value share of the global market in 2014, and it is anticipated that by 2020, it will increase to 24.9%.

In terms of transaction volume, Asia Pacific and Africa will continue to remain lucrative, however, strong growth in North America and Western Europe is anticipated to eat into their market share. On the other hand, the collective market share of Latin America, Middle East, and Eastern Europe is projected to reach 10.4% by 2020.

The key companies profiled in FMI’s research report include PayPal, Visa, MasterCard, and Google Wallet. These companies are tying up with leading vendors to consolidate their position in this rapidly expanding market.

Read Related Reports:

https://medium.com/@akshay.shinde.vu/digital-commerce-platform-market-is-estimated-to-grow-at-a-cagr-of-12-6-during-2022-2029-11542931a540

https://medium.com/@akshay.shinde.vu/according-to-a-report-by-fmi-the-market-for-data-centre-infrastructure-management-is-anticipated-83316e72b1fa

https://medium.com/@akshay.shinde.vu/market-share-demand-analysis-growth-trends-and-forecast-for-visitor-management-systems-through-bb8562410e5c

https://medium.com/@akshay.shinde.vu/dc-powered-servers-market-expected-to-reach-us-1-3-bn-5-cagr-through-2022-2030-dd2d62a0787

About FMI

Future Market Insights (ESOMAR certified market research organization and a member of Greater New York Chamber of Commerce) provides in-depth insights into governing factors elevating the demand in the market. It discloses opportunities that will favor the market growth in various segments on the basis of Source, Application, Sales Channel and End Use over the next 10-years.

Contact:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

Report: https://www.futuremarketinsights.com/reports/global-mobile-payment-transaction-market

For Sales Enquiries: sales@futuremarketinsights.com

Browse latest Market Reports: https://www.futuremarketinsights.com/reports

LinkedIn| Twitter| Blogs