In 2021, global sales in the EUV lithography market were estimated to be USD 4,648.6 million. Looking ahead to 2029, the market is expected to grow significantly, with a projected Compound Annual Growth Rate (CAGR) of 21.5%, reaching an estimated value of USD 22,978.6 million. The term “Extreme Ultraviolet” (EUV) refers to the specific wavelength of light used in this process. The development of more advanced lithographic systems is a key factor driving the adoption of EUV technology.

The EUV Lithography Market report, published by Future Market Insights—an ESOMAR Certified Market Research and Consulting Firm—provides valuable insights and a thorough analysis of the EUV lithography sector. This report covers the scope and core elements of the research, meticulously examining key drivers, market size, and forecast data for EUV lithography. It offers detailed revenue and shipment segmentations, along with a ten-year projection up to 2029. The report also analyzes major industry players, their market presence, competitive dynamics, and regional outlooks.

The EUV lithography market is on the verge of substantial growth, driven by the ongoing push for miniaturization of integrated circuits and microchips, increasing demand for higher wafer production, and the continued expansion of the semiconductor industry. As technology advances to enhance performance and efficiency, the adoption of EUV lithography is becoming crucial for achieving the higher resolution needed for advanced semiconductor manufacturing processes.

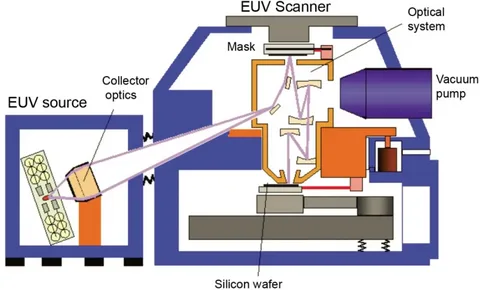

As a key segment of the semiconductor industry, the EUV lithography market focuses on the development and implementation of EUV lithography systems for cutting-edge chip production. This advanced technology enables the precise creation of complex patterns on silicon wafers, facilitating the production of smaller, faster, and more powerful semiconductors.

Future improvements in the integration of EUV lithography for chip manufacturing are closely tied to the continued miniaturization of integrated circuits and microchips, the growing scale of wafer production, and the robust growth of the semiconductor industry. The EUV lithography market is projected to experience a notable CAGR of 21.5% from 2022 to 2029, reflecting its critical role in the future of semiconductor manufacturing.

Currently, many IDMs and foundries are cautious in the adoption of EUV lithography in chip manufacturing, given the infancy of the technology and high upfront costs. However, with continuous innovation and R&D, products are expected to become more efficient and cheaper.

Full Market Assessment: Comprehensive Report

Key Takeaways:

- Reduction of microchip sizes to incorporate them into shrinking semiconductors is one of the prime factors that resulted in the development of EUV lithography technology.

- Emergence of artificial intelligence (AI), machine learning, industrial IoT (IIoT), and autonomous driving has been driving miniaturization of microchips, subsequently creating the need for EUV lithography in chip manufacturing.

- Constant innovation, R&D, and retrofitting of installed systems to improve wafer production, are anticipated to remain key trends in the EUV lithography market.

- Integrated device manufacturers (IDM) and foundries are projected to create bulk of the demand for EUV lithography systems, as they are responsible for majority of the microchip and integrated circuit (IC) demand across industries.

- Acquisition of stakes in key technology-based companies to complement product development is anticipated to remain a prominent trend in the market.

Competitive Landscape

Key players in the EUV Lithography market are focusing on a data-centric approach with an aim of expanding their portfolio of technology solutions that address customer needs. Many key players are also using innovation to expand their product offerings to meet customer requirements. Players are aiming at research & development to develop new products.

For Instance:

- In Jan 2022, ASML and Intel Corporation announced the latest phase of their longstanding collaboration to advance cutting-edge semiconductor lithography technology.

- In April 2019, Taiwan Semiconductor Manufacturing Co. Ltd announced the expansion of the Open Innovation Platform ® (OIP) Cloud Alliance, with Mentor Graphics joining inaugural members Amazon Web Services, Cadence, Microsoft Azure, and Synopsys.

- In March 2019, Samsung Electronics developed a 3rd-generation 10-nanometer-class (1z-nm) eight-gigabit (GB) Double Data Rate 4 (DDR4) DRAM for the first time in the industry.

- In October 2019, SK Hynix developed 1Znm 16GB (Gigabits) DDR4 (Double Data Rate 4) DRAM. As 16 GB is the industry’s largest density for a single chip, the total memory capacity per wafer is also the largest of the existing DRAMs.

Key Players

- ASML

- Nikon

- Canon

- Carl Zeiss

- Toppan Printing

- NTT Advanced Technology

- Intel

- Samsung

- SK Hynix

- Toshiba

- TSMC

- Global Foundries

Global EUV Lithography Market by Category By End Use :

- Integrated Device Manufacturer (IDM)

- Foundry

- Memory

By Region:

- Americas

- EMEA

- Asia Pacific

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube