In 2024, the United States distributed antenna system (DAS) industry is expected to be worth US$ 1,004.4 million. The industry is expected to reach US$ 1,849.9 million by 2034, expanding at a 6.3% CAGR throughout the forecast period.

In the contemporary business landscape, smartphones and internet connectivity have transitioned from being perceived as mere luxuries to indispensable necessities. The proliferation of digital services, ranging from payment platforms to messaging applications, has substantially increased reliance on these devices.

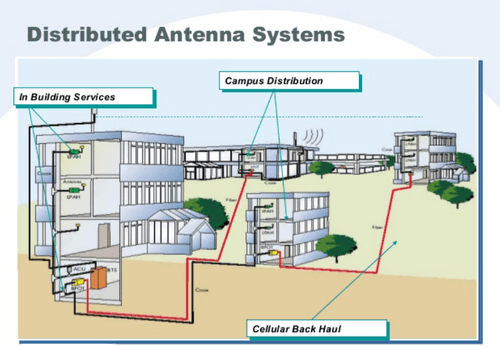

Ensuring a seamless and reliable internet experience for users has become paramount. This growing smartphone usage serves as a catalyst propelling the distributed antenna system (DAS) industry forward. This is due to the ability of DAS to efficiently provide high-speed internet connectivity to densely populated and high-traffic areas, both indoors and outdoors.

Prominent manufacturing facilities increasingly opt for interconnected machinery, facilitating streamlined monitoring by operators and the execution of routine maintenance tasks. This growing IoT device usage within expansive industrial networks propels the prospect of integrating indoor DAS within existing manufacturing facilities.

Such integration is essential to provide tailored, high-quality network services. It helps in ensuring a seamless and robust connectivity experience for IoT devices, further providing better monitoring and insights into operations for factory managers.

A challenge for the United States DAS industry is the integration of fiber optic technology. It necessitates the utilization of custom cabling and installation equipment, contributing to an extended deployment timeline.

The comprehensive deployment cycle is estimated to span around six months or more. This duration encompasses the intricacies of configuring the system to accommodate specific frequency bands and ensuring seamless connectivity through advanced fiber optic infrastructure. The support for wireless connection and mobile communications infrastructure like 5G and LTE is also taken into account.

Key Takeaways from the United States Distributed Antenna System Industry:

- The DAS industry in the United States is predicted to reach US$ 1,849.9 million by 2034, increasing at a 3% CAGR.

- With an estimated share of 3% by 2024, the active distributed antenna system segment is estimated to dominate the United States DAS industry.

- With a CAGR of 9% from 2024 to 2034, the hybrid DAS segment is estimated to rise steadily in the United States.

- By product, the antennas segment is anticipated to hold a dominant share of 1% and a value of US$ 412.7 million in 2024.

- The public venue segment by end-user is anticipated to generate a dominant share of 4% and reach a value of US$ 395.4 million in 2024.

Competitive Landscape

The distributed antenna system industry in the United States is a highly competitive area, with a significant number of players competing for high shares. Among the leading players in this industry include start-ups like Advance RF technology, Dali Wireless, and ComTech. American Tower Corporation, Anixter, Inc., Corning and CommScope are a few of the established companies.

Key players are focusing on business expansion through collaborations. They are investing in product development and building strategic partnerships to help small-scale firms deploy DAS systems.

For instance,

- Boingo joined hands with Austin FC in January 2023 to design, install, and manage a converged network. It combines Wi-Fi 6 solutions and a distributed antenna system (DAS) to support an immersive fan experience at the Q2 Stadium in Texas.

Key Segments of Distributed Antenna Systems (DAS) Industry

By DAS Type:

In terms of DAS Type, the industry is segregated into Active Distributed Antenna Systems (DAS), Passive Distributed Antenna Systems (DAS) and Hybrid Distributed Antenna Systems (DAS).

By Product:

The Product is classified by industries as Antennas, Bi-Directional Amplifiers (BDAs), Remote Radio Heads (RRH), Fiber Optic Cables, Splitters and Couplers and Other Devices.

By Application:

In terms of Application, the End User is distributed into Indoor Coverage and Outdoor Coverage.

By End User:

In terms of End User, the End User is distributed into Commercial, Industrial, Public Venues and Residential Building.

By Region:

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries. Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube