The global market for emission control catalysts is expected to rise due to stringent regulations, rising environmental awareness, and technological advancements. Emission control catalysts play a crucial role in reducing harmful pollutants, and their efficiency can be improved through recycling.

The global emission control catalyst market size and forecast is estimated to be valued at USD 13964.6 million in 2024 and further increase at a CAGR of 8.5% during the assessment period. Worldwide sales of emission control catalysts are set to total USD 31707.5 million by 2034.

The prevalence of electric vehicles (EVs) may reduce the need for catalysts. Valuable metals like platinum and palladium are essential components, and fluctuations in metal prices can impact production costs. As vehicles age, the demand for replacement catalysts will likely increase, opening new opportunities for the aftermarket segment.

Governments’ strict emission control regulations and public concern for air pollution are driving demand for clean technologies like catalytic converters. Emerging nations’ increased vehicle production will likely create a significant catalyst market. The stationary source segment’s growth is set to fluctuate, but sales of advanced catalysts with improved efficiency and reduced emissions are expected to surge.

Major factors contributing to the market growth are:

- Strict regulations are implemented by the government regarding emission control.

- Measures were taken by the automotive manufacturers to cut down carbon emissions.

- Rapid urbanization worldwide

Key Takeaways from the Market Report

- The global emission control catalysts market is set to reach USD 31707.5 million by 2034, with a CAGR of 8.5%.

- Based on product type, diesel-based emission catalysts accounted for a market share of 79.4% in 2024.

- By application, mobile equipment is leading with a market size of 65.4% in 2024.

- India is anticipated to record a CAGR of 12.7% between 2024 and 2034.

- Sales in China are forecasted to rise at a CAGR of 9.6% by 2034.

“The global market for emission control catalysts is expanding as a result of strict regulations established to regulate air pollution. Increasing concerns about the automotive industry’s decreasing carbon footprint are also set to push demand,” Says Nikhil Kaitwade, Associate Vice President at Future Market Insights (FMI).

How will Expanding Automotive Sector Affect Emission Control Catalyst Sales?

Despite the unstable economic conditions, the global automotive industry is anticipated to register sustainable growth in terms of demand and sales backed by the growing adoption of diesel-engine vehicles. This will create a positive outlook for the emission control catalyst market.

The expansion of the automotive sector in emerging countries can be attributed to the rising popularity of lightweight vehicles. The demand for passenger vehicles also will continue rising in India, China, Brazil, and other emerging markets, bolstering the scope for increasing automotive production.

The increasing sales, steered by the growing population and rising disposable income, will further provide lucrative opportunities for emission control catalyst manufacturers.

Besides this, the implementation of stringent government regulations will push sales of automotive telematics, emission control catalysts, and other equipment often integrated to curb vehicular emissions.

Which is the Primary Application of Emission Control Catalyst?

In terms of application, the mobile equipment segment is expected to show high demand due to increasing applications of emission control catalysts in automobiles. Application of emission control systems in passenger cars, lightweight and heavyweight vehicles, two-wheelers, and three-wheelers will augment the market growth.

Also, the implementation of stringent emission control laws in several countries has compelled manufacturers to use advanced emission control systems in the production of heavy-duty, passenger, on-road and off-road vehicles. This is a key factor bolstering the growth of the emission control catalyst market.

Based on the end user, the OEM segment has the highest market share

Being a high-involvement product, the manufacturers would want to take utmost care while purchasing emission control catalysts. Apart from reducing emissions, the manufacturers ensure that the efficiency of the engine doesn’t come down because of deploying ECC. This has led to a number of manufacturers depending on the OEM.

Apart from that, the purchase from OEM ensures that the quality of the catalyst is not all compromised. Moreover, these manufacturers also provide extended warranty periods, which increases the end user’s confidence in the product. Finally, the return on investment is much higher as the end users would be implementing genuine catalysts.

Who is Winning?

Key players in the emission control catalyst industry, including Aerinox-Inc., BASF SE, CDTi Advanced Materials Inc., Clariant, and CORMETECH, are investing in creating durable, efficient catalyst materials for precious metals. They are integrating machine learning and simulation tools to optimize performance and predict potential issues.

The industry is also focusing on automotive and industrial sectors, developing customizable catalyst solutions for various emission profiles. Collaboration with automakers and equipment manufacturers is crucial for integrating these solutions.

Manufacturers are also collaborating with research organizations and academic institutions to advance next-generation catalyst technologies. Automation and digital tools are being used to streamline production, reduce waste, and minimize energy consumption.

Industry Updates

- Researchers from Northern Illinois University, Valparaiso University, and the United States Department of Energy’s (DOE) Argonne National Laboratory, in May 2024, found a family of catalysts that effectively transforms CO2 generated from industrial emissions into commonly used compounds.

- The CHASS project was implemented in November 2023 to improve the longevity and effectiveness of Cu-CHA catalysts and enhance the environmental impact of diesel vehicles.

Get More Insights into the Emission Control Catalyst Market Report

In its latest report, Future Market Insights (FMI) offers an unbiased analysis of the emission control catalyst market, providing historical data from 2019 to 2023 and forecast statistics for the period 2024 to 2034. To understand the industry potential, growth, and scope, the industry is segmented based on metals (platinum, palladium, rhodium, and other metals), product type (diesel-based emission catalysts and gasoline-based emission catalysts), end-use (automotive and industrial), catalytic converter type (diesel oxidation catalyst, selective catalytic reduction, lean NOx trap, three-way catalytic converter, and four-way catalytic converter), application (mobile emission control catalysts and stationary emission control catalysts), and region (North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa).

Key Segments of Market Report

By Metal:

Based on metal, the sector is divided into platinum, palladium, rhodium, and other metals.

By Product Type:

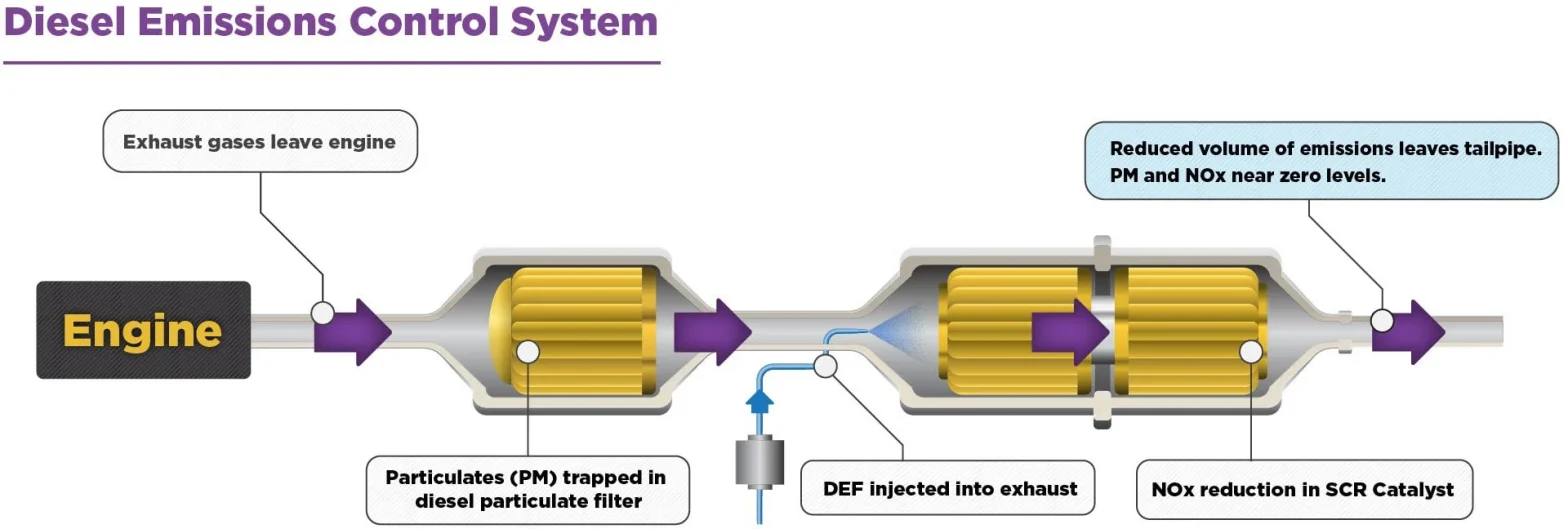

By product type, the industry is divided into diesel-based emission catalysts and gasoline-based emission catalysts. The diesel-based emission catalysts segment is segregated into diesel oxidation catalyst, selective catalytic reduction catalyst, diesel particulate filter, ammonia oxidation catalyst, and NOx absorbers. Gasoline-based emission catalysts are divided into palladium-based, rhodium-based, and platinum-based catalysts.

By End-use Industry:

By end-use industry, the sector is segmented into automotive and industrial.

By Catalytic Converter Type:

Based on catalytic converter type, the industry is divided into diesel oxidation catalyst, selective catalytic reduction, lean NOx trap, three-way catalytic converter, and four-way catalytic converter.

By Application:

Emission control catalysts have applications in mobile emission control and stationary emission control catalysts. Mobile emission control catalysts are segregated into heavy-duty vehicles, off-road vehicles, passenger cars and light duty vehicles, motorcycles, scooters and three wheelers, and gardening equipment. Stationary emission control catalysts are divided into stationary emission control catalysts, generators, industrial engines, and off-road equipment.

By Region:

The emission control catalyst industry is spread across North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa.

Read Complete Study: Emission Control Catalyst Market Size to Reach USD 31,707.5 Million by 2034 Driven by Stricter Environmental Regulations | Future Market Insights, Inc.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube