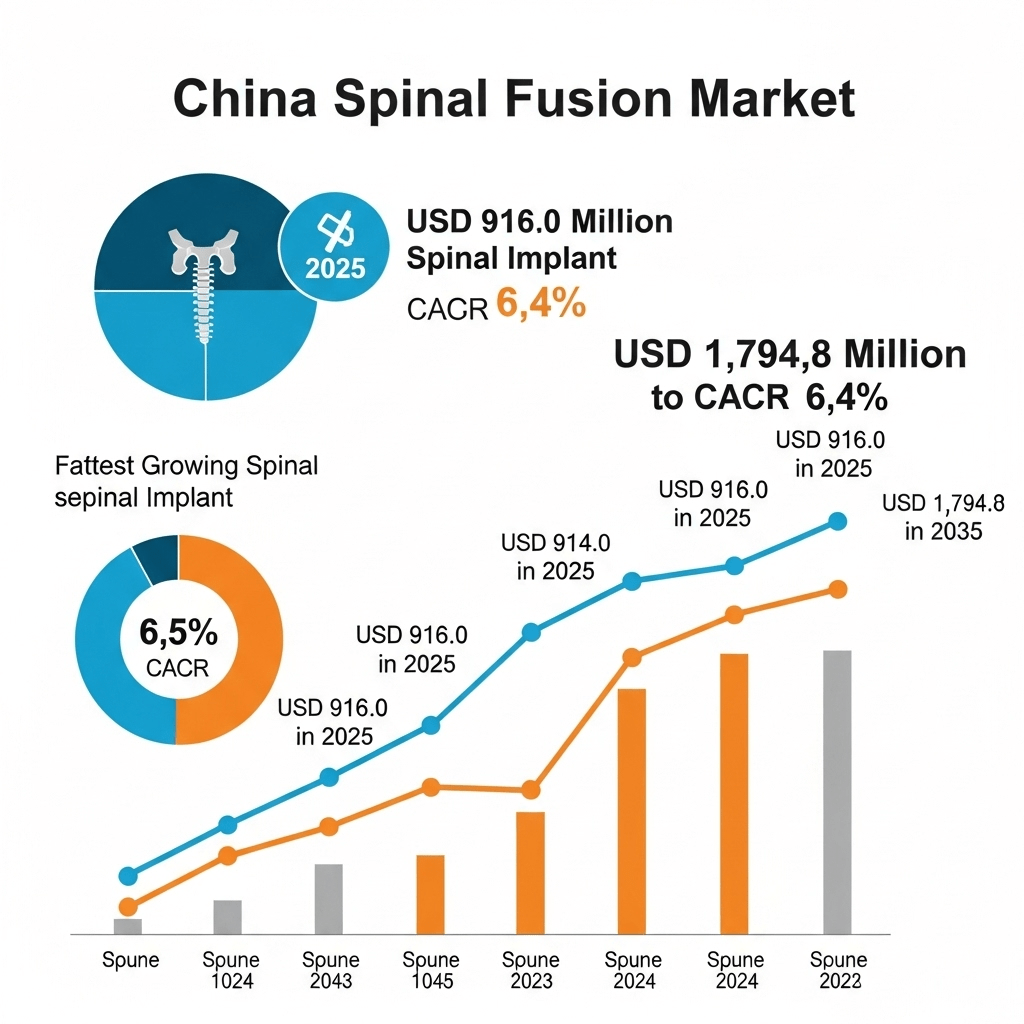

The China spinal fusion market is valued at USD 916.0 million in 2025 and is projected to grow to USD 1,794.8 million by 2035, expanding at a CAGR of 6.4%. The spinal implant segment is the fastest-growing, with a CAGR of 6.5%.

Market Trends

- There is a clear shift towards minimally invasive spinal fusion surgeries, which offer quicker recovery and reduced hospital stays.

- The adoption of robot-assisted surgical systems is on the rise, improving precision and outcomes.

- 3D printing technology is being increasingly used for customizing implants, enhancing spinal fusion success rates.

- Rising patient preference for outpatient procedures is influencing hospitals and surgical centers to upgrade their technology.

- Surgeons are showing a growing interest in biologics and bone graft substitutes, which promote natural bone healing and reduce surgery time.

Get Sample Report: – https://www.futuremarketinsights.com/reports/sample/rep-cn-877

Driving Forces Behind Market Growth

- A major growth driver is the increasing geriatric population in China, leading to higher incidences of osteoporosis and spinal stenosis.

- Rapid urbanization and sedentary lifestyles have contributed to a surge in spinal disorders among younger demographics.

- Technological advancements in spinal implants and navigation systems have increased surgical success and reduced complications.

- Government initiatives aimed at improving healthcare accessibility in rural and urban areas are expanding the reach of spinal care services.

- Rising income levels and enhanced insurance coverage are encouraging more people to opt for elective spinal fusion surgeries.

Challenges and Opportunities

- One of the key challenges is the high cost of spinal fusion procedures, which may limit access for lower-income groups.

- A shortage of skilled spine surgeons and specialists in some regions hampers market penetration.

- The complex regulatory approval process for innovative devices slows down the introduction of new technologies.

- Despite these hurdles, the market presents vast opportunities with the expansion of domestic manufacturing capabilities, reducing reliance on imports.

- Collaboration between local hospitals and international medtech firms offers avenues for technology transfer and clinical training, enhancing overall treatment standards.

Regional Analysis

- Eastern China, particularly cities like Shanghai and Beijing, leads the market due to better medical infrastructure and high healthcare spending.

- Southern China, including provinces such as Guangdong, is witnessing increased adoption of spinal fusion techniques thanks to rising disposable income and awareness.

- Western regions, though relatively underdeveloped, are now benefiting from government-led healthcare reforms and infrastructural improvements.

- The central provinces are emerging markets, with growing patient demand and hospital expansions playing pivotal roles.

- Rural areas still lag in access but are increasingly being targeted through telemedicine and mobile healthcare initiatives.

Top Companies

- Several domestic and international players are contributing to the growth of the China spinal fusion market:

- Medtronic: A global leader known for innovative spinal implants and navigation systems.

- Zimmer Biomet: Offers a wide range of spinal fusion devices with a strong presence in urban hospitals.

- Johnson & Johnson (DePuy Synthes): Provides advanced spinal solutions and is active in physician training programs.

- NuVasive: Specializes in minimally invasive surgery technologies that are gaining popularity in China.

- Weigao Orthopaedic Device: A prominent Chinese company focusing on cost-effective spinal implants for local markets.

- Orthofix and Globus Medical: Known for their cutting-edge product portfolios and expanding footprint in China.

Explore In-Depth Analysis-Click Here to Access the Report:- https://www.futuremarketinsights.com/reports/spinal-fusion-market

Segmentation Outlook

- The China spinal fusion market can be segmented based on:

- Procedure Type: Includes anterior cervical fusion, posterior lumbar fusion, and thoracic fusion procedures.

- Product Type: Covers devices such as interbody cages, rods, screws, and bone graft materials.

- End User: Comprises hospitals, specialty clinics, and ambulatory surgery centers, each with different purchasing preferences and capacities.

- Material: Titanium-based implants, PEEK materials, and biodegradable options are key segments under review.

- Age Group: While geriatric patients dominate the segment, an increasing number of younger individuals are undergoing spinal fusion due to sports injuries and work-related spinal strain.