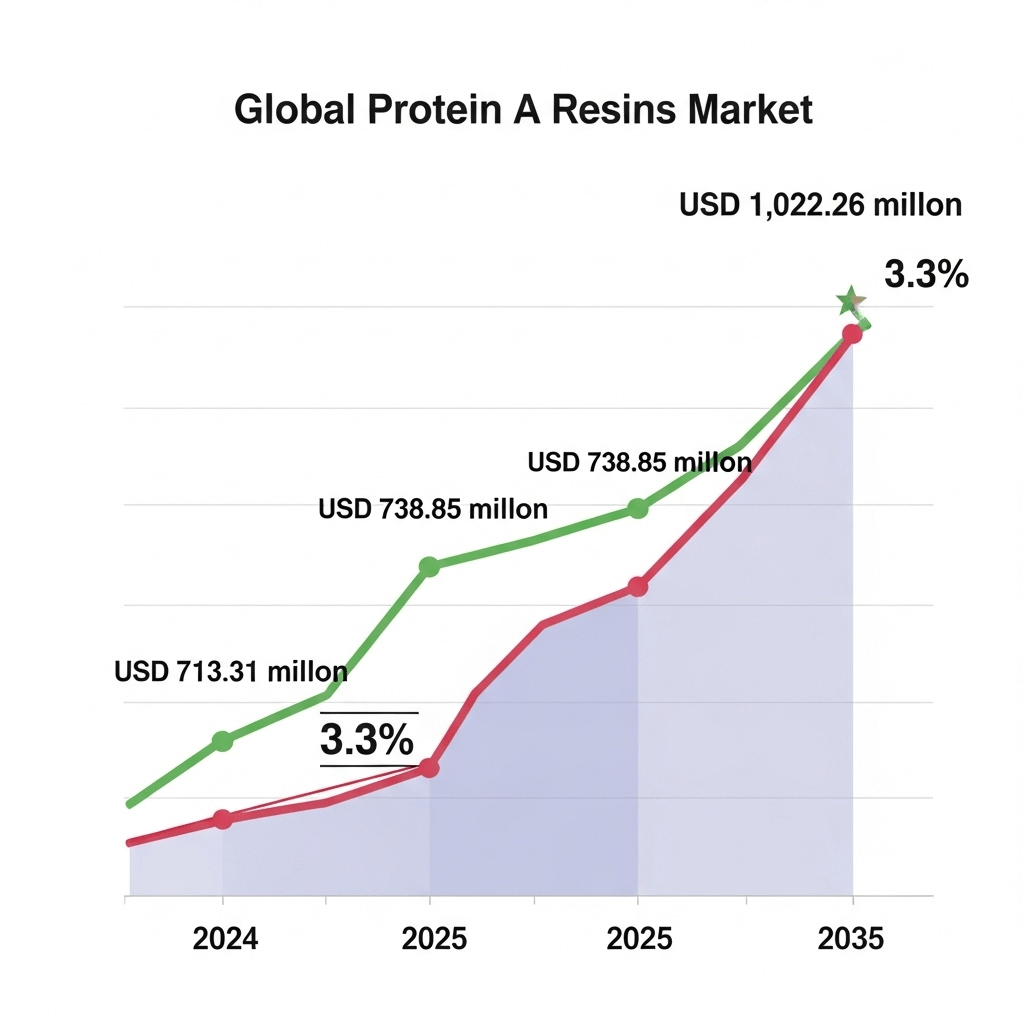

The global Protein A Resins market is expected to grow from USD 713.31 million in 2024, to USD 738.85 million in 2025 and USD 1,022.26 million by 2035. The revenue during the forecast period is projected to grow with a CAGR of 3.3%.

The Protein A resins market is a critical segment within the biotechnology and pharmaceutical industries. Protein A resins are specialized materials used predominantly for antibody purification in bioprocessing. As demand for biologics and monoclonal antibodies continues to rise, the market for Protein A resins has experienced significant growth. Understanding the current landscape, size, trends, and key players in this market is essential for stakeholders aiming to make informed decisions and capitalize on future opportunities.

Get Sample Report: – https://www.futuremarketinsights.com/reports/sample/rep-gb-1720

Size & Trends

The Protein A resins market has witnessed steady expansion driven by the increasing need for high-purity antibodies in therapeutic and diagnostic applications. The global market size reflects strong growth fueled by innovations in resin technology and rising biopharmaceutical production. Some of the notable trends shaping the market include:

- Increasing adoption of monoclonal antibodies for cancer and autoimmune diseases, propelling the demand for Protein A resins.

- Development of more durable and cost-effective resins that improve binding capacity and reusability.

- Expansion of biopharmaceutical manufacturing facilities worldwide, especially in emerging economies.

- Growing preference for single-use technologies in downstream processing that incorporate Protein A resins.

- Advancements in purification techniques that enhance product yield and reduce processing time.

These trends indicate a vibrant and evolving market that continues to adapt to the increasing complexities of bioprocessing.

Challenges and Opportunities

While the Protein A resins market shows promising growth, it faces several challenges that need addressing for sustained progress:

- High production costs: Manufacturing Protein A resins involves complex processes and expensive raw materials, which can increase the final cost.

- Stability and leaching issues: Protein A ligands may leach during purification, impacting product safety and resin lifespan.

- Stringent regulatory requirements: Compliance with regulatory standards for biologics manufacturing imposes constraints on resin development and usage.

- Competition from alternative purification methods: Emerging technologies such as mixed-mode chromatography and peptide-based ligands may challenge traditional Protein A resins.

Despite these challenges, there are significant opportunities for innovation and market expansion:

- Enhancing resin robustness: Developing resins with improved chemical and physical stability can reduce overall costs and increase adoption.

- Customization for specific applications: Tailoring resins to specific antibody types or processes offers competitive advantages.

- Geographical market penetration: Expanding into untapped regions with growing biopharmaceutical sectors can drive demand.

- Sustainability focus: Creating eco-friendly and recyclable resins aligns with increasing environmental awareness in manufacturing.

Addressing these challenges while leveraging the opportunities will be vital for companies to strengthen their market presence.

Market Share by Geographical Region

The Protein A resins market exhibits distinct regional dynamics, influenced by factors such as pharmaceutical infrastructure, investment levels, and regulatory environments. The main regions include:

- North America: This region holds a significant share of the market due to its advanced biopharmaceutical industry, high R&D investments, and presence of major pharmaceutical companies.

- Europe: Europe is a mature market with strong emphasis on innovative biologics and regulatory compliance, supporting consistent demand for Protein A resins.

- Asia-Pacific: This region is the fastest-growing market, driven by expanding healthcare infrastructure, rising biologics manufacturing, and increasing government initiatives promoting biotechnology.

- Rest of the World: Markets in Latin America, the Middle East, and Africa are emerging, with gradual adoption of advanced bioprocessing technologies.

The geographical distribution of market share highlights both the maturity of established regions and the growth potential of emerging markets.

Top Companies

Several key companies dominate the Protein A resins market, leveraging strong technical expertise and global distribution networks. These companies invest heavily in research and development to enhance resin performance and meet evolving industry needs. Some of the top players include:

- Companies known for pioneering high-capacity and reusable Protein A resins.

- Firms that offer integrated purification solutions combining resins with chromatography systems.

- Corporations with extensive regulatory experience enabling them to cater to pharmaceutical-grade applications.

- Businesses expanding their footprint through strategic partnerships and acquisitions.

The competition among these top companies fosters continuous innovation and drives improvements in quality, efficiency, and cost-effectiveness.

Explore In-Depth Analysis-Click Here to Access the Report:- https://www.futuremarketinsights.com/reports/protein-a-resins-market

Segmentation Outlook

The Protein A resins market can be segmented based on several factors, each offering insights into specific customer requirements and technological preferences:

- Type of Resin: This includes agarose-based, cellulose-based, and synthetic resins. Agarose-based resins are widely used for their excellent binding capacity and selectivity.

- Application: Therapeutic antibody purification dominates, but diagnostic and research applications are also significant.

- End-User: Biopharmaceutical companies, contract manufacturing organizations (CMOs), and academic research institutions form the primary user base.

- Form Factor: Bulk resins for in-house purification and pre-packed columns for ease of use in downstream processing.

- Geography: Regional segmentation helps identify market demand patterns and growth drivers.