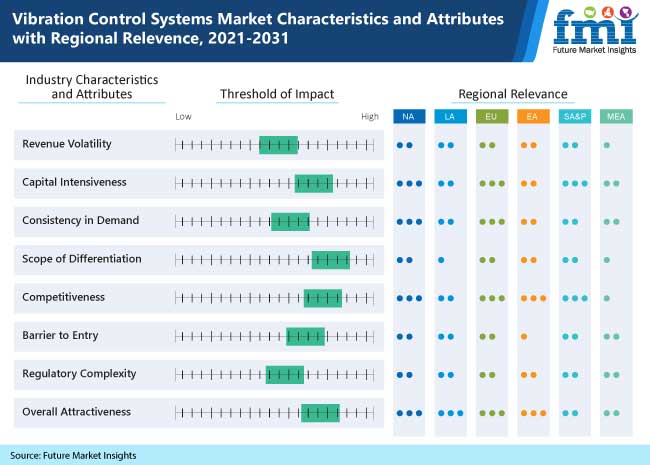

Demand for vibration control systems is likely to witness a revival in 2021, according to the latest edition of the study by ESOMAR-certified market research firm, Future Market Insights (FMI). The study also finds that a significant percentage of industry players are confident of growing investments in automation, a strategy stalled by COVID-19 outbreak. However, the pace of recovery is likely to be muted in 2021, with a robust recovery anticipated in 2022 onward.

As the automotive industry has grown in recent years, so has the demand for various types of vibration control systems such as automation control, motion control, vibration control, and others. With vibration control system manufacturers releasing a slew of new products, Future Market Insights (FMI) anticipates a bullish outlook from 2021 to 2031.

As the key end-use industries such as mining & quarrying, food manufacturing, textiles, and others are subject to expend further, the vibration control system manufacturers are expected to witness significant demand in the future.

Request for a sample@

https://www.futuremarketinsights.com/reports/sample/rep-gb-4595

Key Takeaways

- High demand for anti-vibration cylinders likely to be witnessed

- Original Equipment Manufacturers (OEM) continue to be preferred by end-users

- Rise in requirement from transportation industry to fuel sales of vibration control systems

- Sales in US will be nearly 50% of global demand

- China remains a strong market in APAC

- Sales in Japan and South Korea expected to recover steadily

“With rise in requirement from end-users with fast-paced growth, vibration control system manufacturers are projected to witness significant opportunities. Surge in demand for vibration control system will propel the growth while this segment will hold nearly 30% of the market share,” says an FMI analyst.

Automotive Industry Outlook Key to Future Sales

As vibration control is of utmost importance in automotive industry, the steady growth in this industry is raising the demand for it further around the globe. According to the European Commission (EC), the automotive industry is crucial for Europe’s prosperity, representing 8.5% of European Union (EU) employment in manufacturing, while the turnover generated by the automotive industry in Europe represents over 7% of EU GDP.

According to the Select USA, the U.S. automotive industry is expanding steadily, while in 2018, the additional exports of automotive parts were valued at US$ 88.5 billion. As stated by the United States Auto Alliance, of the US$ 105 billion spent on R&D globally, almost a fifth (US$ 18 billion) was spent in the U.S. in 2018. As these rates are forecast to increase further, the players in the vibration control system industry are set to experience significant growth in the coming years.

Who is Winning in this Space?

The global vibration control system market remains fiercely competitive. To consolidate their position, the key players are emphasizing on diversifying their products. For instance,

- Lord Corporation announced a new brand for its portfolio of electromechanical products: Lord Electromechanical Solutions in 2018

- Cooper Standard launched its new range of vibration control system solutions applicable for diverse end-use industries, while it named to Newsweek’s America’s most responsible companies 2021 list

Ask an analyst@

https://www.futuremarketinsights.com/ask-question/rep-gb-4595

More Valuable Insights on Vibration Control System Market

In its latest report, FMI offers unbiased analysis of the global vibration control system market, providing historical data for the period of 2016–2020 and forecast statistics for the period of 2021–2031. In order to understand the global market potential, its growth, and scope, the market is segmented on the basis of system (vibration controls (isolating pads, isolators (metal, rubber), couplings (spool, shear, bolt, bush), anti-vib cylinders (male, female)), motion controls (springs (air, coil), hangers, washers & bushes, mounts (hydraulic, pneumatic)), automation control (absorber (miniature, industrial, heavy industrial), dampers (hydraulic, pneumatic, damping pads))), end-users (mining & quarrying, oil & gas, utilities, transportation, food manufacturing, beverages & tobacco, textile mills, bi-products, chemical manufacturing, electrical equipment, machinery manufacturing), across seven major regions of the world (North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA).

Read More:

https://hackernoon.com/preview/I5wz5cHBRF4Qt75BisIq

https://www.mioola.com/Sonufmi/post/53674448/

https://princepawar0.blogspot.com/2022/07/switchgear-market-recent-trends-demand.html