The Indian coronary stent market is expected to witness a substantial leap, with a projected market size of US$ 1,213.5 million by 2033, compared to US$ 843.8 million in 2023. This significant expansion is attributed to an anticipated Compound Annual Growth Rate (CAGR) of 3.7% in the demand for coronary stents within India over the next decade.

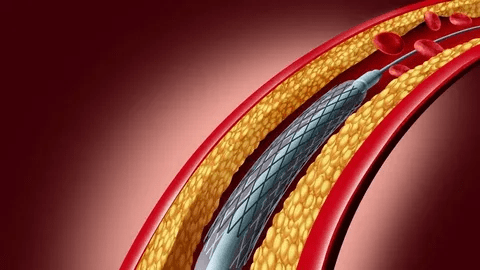

The surge in coronary stent adoption is primarily driven by the alarming rise in cardiovascular disease (CVD) across India. This concerning trend is linked to factors like an aging population, increasing urbanization, and unhealthy lifestyle choices. Consequently, the demand for coronary stents, which play a vital role in managing CVD, has witnessed a significant upswing.

Explore With Your Report Sample: https://www.futuremarketinsights.com/reports/sample/rep-in-1485

Furthermore, the Indian healthcare landscape is experiencing a growth in the number of interventional cardiologists, coupled with an expansion of Cath labs. These advancements are evident in both public and private hospitals, with new corporate hospitals further contributing to the market’s expansion.

Factors Fueling the Growth:

- Rising CVD Incidence: The alarming increase in cardiovascular disease creates a critical need for effective treatment options, including coronary stents.

- Expanding Medical Infrastructure: The number of interventional cardiologists and Cath labs is steadily increasing in both public and private healthcare facilities, including new corporate hospitals. This enhanced infrastructure facilitates a wider range of cardiac interventions.

- Government Initiatives: Supportive government programs aimed at improving healthcare accessibility and infrastructure play a crucial role in the growth of the coronary stent industry. Initiatives focused on regulating prices and enhancing access to cardiac treatments, such as the National Pharmaceutical Pricing Authority of India (NPPA)’s reduction in DES prices in February 2018, further stimulate the market by making coronary stents more affordable.

“There is a sizable untapped industry in rural places where access to high-quality healthcare is scarce. The development of healthcare infrastructure in these areas offers coronary stent producers a huge window of opportunity for expansion,” according to a lead healthcare industry analyst at Future Market Insights.

Understand Our Methodological Process: https://www.futuremarketinsights.com/request-report-methodology/rep-in-1485

Key Takeaways

- In patients with PCI with a high risk of bleeding, a balloon stent covered with paclitaxel and iopromide is preferable over bare metal stents in India.

- In 2023, drug-eluting stent is leading the adoption of coronary stents in India, favored for their proven effectiveness and global acceptance in the medical community.

- Abbott Laboratories is India’s industry leader for coronary stents as of 2023, followed by Biotronik SE & Co, Boston Scientific, and Medtronic.

Competitive Landscape

In the coronary stent industry, one can observe a certain level of fragmentation, marked by numerous contenders vying for a slice of the industry pie. Alongside dominant leaders, there exists a significant presence of smaller regional players, contributing to a competitive landscape. As part of their strategic approach, manufacturers have invested substantial resources into research and development. They have also adeptly adjusted pricing models to maintain competitiveness, with a focus on reaching a broader customer base without compromising product quality.

Recent Developments

- The E-MAGIC Plus Sirolimus Drug-Eluting Stent was introduced by Opto Eurocor Healthcare Limited (OEHL), a division of Bangalore-based Opto Circuits (India) Ltd., a medical equipment manufacturer. The launch occurred after receiving permission from the Drug Controller General of India (DCGI) to sell and advertise the medicine in India. With the introduction of E-MAGIC Plus, Opto Circuits has joined a select group of international companies that provide DES devices with two drug coatings.

- For eligibility to sell Infinnium in the European Union and numerous other countries across the world, Sahajanand Medical Technologies (SMT) has been granted CE certification, a certificate of authorization. The Infinnium paclitaxel-eluting coronary stent system is a first-of-its-kind locally designed coronary stent for treating coronary artery disease (CAD) and provides unparalleled clinical outcomes with an outstanding safety profile.

Key Industry Players Profiled in the India Coronary Stent Report:

- Abbott Laboratories

- Medtronic, Inc.

- Biosensors Inc.

- Boston Scientific Inc.

Gain Full to Market Insights: Purchase Now to Access: https://www.futuremarketinsights.com/checkout/1485

Key Segments:

By Product Type:

- Drug-eluting Stent

- Bare Metal Stent

- Bioresorbable Vascular Stent

By Raw Material Type:

- Cobalt Chromium

- Stainless Steel

- Platinum Chromium

- Polymer

By End User:

- Hospitals

- Ambulatory Surgical Centres

- Cardiac Catheterization Laboratories

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube