Newly released data by Future Market Insights (FMI) shows that the global car rental services market is expected to reach a valuation of US$ 134 Bn in 2021. Growing popularity of ride-sharing services is expected to augment the growth of the market, pushing sales at a 7.2% CAGR over the assessment period.

Subscription models are increasingly gaining traction among consumers as they are cost-effective and offer more convenience. Driven by this, various OEMs are entering the market with improved service offerings, which is expected to augment the growth of the market.

Further, players are aiming to improve their present working models, while utilizing their abilities in fleet management and existing public fleet presence to gain a competitive advantage.

Vehicle subscriptions are expected to entice customers who may not represent conventional customer profiles for OEMs. For example, few extravagant OEMs are trying membership models widen their customer base.

Moreover, the car subscription model permits customers to maintain a strategic distance from upfront capital necessities and long-term contracts related with buying or renting. It also allows consumers to access comfort and adaptability with the “all-in” month-to-month expense and responsibility.

- To Get a Sample Copy of the Report visit @ https://www.futuremarketinsights.com/reports/sample/rep-gb-975

2016-2020 Global Car Rental Service Market Outlook Compared to 2021-2031 ForecastAdvancements in technology are enabling the expansion of web-based sales channels, which is resulting in higher sales in the market. Online platforms allow customers to rent a car anytime and anywhere. They also assist the renter in initiating and manageing their reservations and payments on the go from a smartphone or tablet.

The car rental service business is a vision of a more flexible, faster, and responsive industry. Players such as The Hertz Corporation, Enterprise Holdings Inc., Avis Budget Group, and others already utilizing updated technologies to improve their customer experience as well as service.

For instance, National Car Renta, a subsidiary of Enterprise Holdings. Inc., has come up with the latest version of its National app. The app allows customers to skip the line and pick the car of their choice where it’s available. It also allows customers to select the before they arrive at the car rental location.

Further, opaque renting is a booking platform that allows online customers to offer the value they need to pay for a specific travel-related product or service without knowing the brand. The brand is revealed after the customer makes the online purchase. This platform gives rental car companies a chance to improce sales and to use their fleet to full capacity.

These trends are gaining traction amaong market players as consumers are seeking more cost-effective car rental services. Technological advancement in mobile capabilities, combined with the development of web-based media reinforces the opaque customer’s position and draw more cost-driven customers toward the opaque booking channel.

Backed by the aforementioned factors, sales are projected to increaset at a healthy 7.2% CAGR over the assessment period.

Request Complete TOC Of this Report @ https://www.futuremarketinsights.com/toc/rep-gb-975

Key Takeaways:

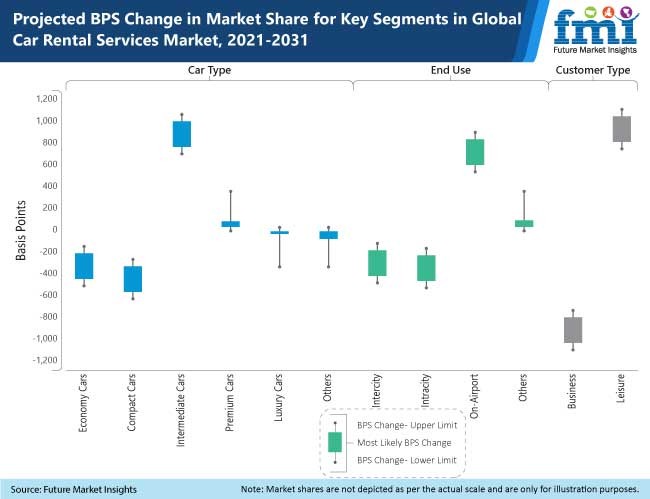

- Based on car type, demand for economy cars is expected to surge at a considerable pace over the forecast period.

- In terms of end use, the on-airport segment is projected to remain dominant through 2031.

- Sales in the mobile application segment are forecast to continue gaining traction over the forecast period.

- The U.S. is expected to dominate the North America market owing to the presence of key market players and increasing preference for ride-sharing services.

- Demand in the U.K. is expected to remain high due to growing prevalence of medical tourism in the country.

Competition LandscapeSome of the key players operating in the car rental services market are Enterprise Holdings Inc., The Hertz Corporation, Avis Budget Group, Europcar Group, Carzonrent, Sixt SE, AI Futtaim Group, Localiza-Rent A Car, Eco Rent A Car, and GlobalCARS among others.

Leading players operating in the market are offering services aligned with consumers’ expectations to gain a competitive edge in the market. Besides this, players are investing in mergers, acquisitions and collaborations to strengthen their footprint in the market. For instance:

- In January 2020, Localiza Rent A Car SA had been ranked 7th place in customer service – EXAME / IBRC (Ibero-Brazilian Institute for Customer Relations)

- In 2019, Enterprise Holdings, Inc. had acquired Romsey-based car rental company, SHB Hire Ltd. The latter operates a fleet of over 18,500 commercial vehicles and this acquisition would help the company to form one of the largest U.K. commercial vehicle rental business.

- In 2019, Hertz Global Holdings and Air France jointly launched Hertz DriveU, which had designed to meet all customer transportation needs.

Car Rental Services Market by CategoryBy Car Type:

- Economy Cars

- Compact Cars

- Intermediate Cars

- Premium Cars

- Luxury Cars

- Others

By End Use:

- Intercity

- Intracity

- On-Airport

- Others

By Consumer Type:

- Business

- Leisure

By Booking Mode:

- Offline Access

- Mobile Application

- Other Internet Access

By Sector:

- Organized

- Unorganized

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- Middle East and Africa (MEA)