Malonic acid, formula CH2(COOH)2, is also known as propanedioic acid. It is a white crystalline dicarboxylic acid compound that is readily soluble in alcohol & ethers. Through ionization of malonic acid, malonic esters are produced, which are called as malonates. Historically, the first synthesis of malonic acid was carried out through oxidation-reduction of malic acid with potassium dichromate. With industrial developments and advancements in manufacturing technology, several methods for the production of malonic acid were developed and commercialized. Moreover, commercially, malonic acid is produced from chloroacetic acid and diethyl malonate.

Request a sample to obtain authentic analysis and comprehensive market insights at- https://www.futuremarketinsights.com/reports/sample/rep-gb-6550

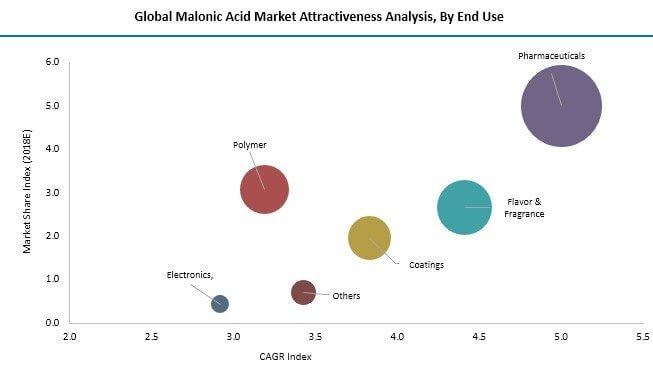

As an intermediate, malonic acid is used in the manufacturing of alkyd resins, which are further used in coating applications to prevent damage caused due to oxidation, UV light and corrosion. Also, malonic acid is used as a cross linker in low-temperature cure powder coatings to accelerate the coating process. Moreover, malonic acid is also used to induce cross-linking in starch compounds, which are further used in the manufacturing of biodegradable thermoplastics. Furthermore, as a building block, malonic acid is used in the production of pharmaceutical compounds, specialty polyesters, flavor and fragrance compounds and electrolyte additives, among others.

Upsurge in demand from pharmaceutical & Coating industry

Over the recent past, there has been significant growth in malonic acid consumption. This can mainly be attributed to growing demand from the pharmaceutical and coating industry. Rise in demand for malonic acid as an active pharmaceutical ingredient (API), supported by its increasing utilization for producing Diclazuril, non-steroidal anti-inflammatory agents and various vitamins, such as B1, B2, B6, among others, have been the key driving factors responsible for its growth. Moreover, macroeconomic growth of the pharmaceutical industry in developing countries, such as China, India, ASEAN and African countries, will be a prominent factor supporting its market growth.

Further, malonic acid finds usage as a crosslinking agent in low temperature powder coatings. With the paints & coatings industry shifting towards water-based and powder coating systems, from traditional solvent-borne coatings, the demand for malonic acid is expected to witness a healthy upsurge. These non-conventional paints and coatings significantly reduce the volatile organic compound (VOC) emissions, in turn, causing increased traction across various parts of the world.

Discover more about report analysis with figures and data tables, along with the table of contents. Request for TOC- https://www.futuremarketinsights.com/toc/rep-gb-6550

Global Malonic Acid Market: Key Players

The malonic market is a highly fragmented market and a significant share of the market is accounted by the presence of small to the medium players. Some of the key players identified across the value chain of the global Malonic Acid market include Lonza Group, Trace Zero LLC., Wuhan Kemi-Works Chemical Co., Ltd., Hefei TNJ Chemical Industry Co.,Ltd., Shanghai Nanxiang Reagent Co., Ltd., TATEYAMA KASEI co.,Ltd, MedicalChem(Yancheng)Manuf.Co.,Ltd., Columbus Chemical Industries, Inc., J&K Scientific Ltd.,etc.

Opportunities for Market Participants

Adoption of organic and inorganic growth strategy and increasing demand from end-use industries, such as polymer & plastic, coating and pharmaceutical industry, among others, will support demand in the global market. Regulations pertaining to the use of bio-based chemicals in Europe and the U.S. will support sustainable development because of which several players are emphasizing on the development of bio-routes for the production of malonic acid. A report published by the U.S. Department of Energy on Top 30 value-added chemicals that can be produced from biomass-derived sugar identified malonic acid as one of the prominent chemicals. Consequentially, several players are focusing on the development of bio-based routes for the manufacturing of malonic acid to comply with government regulations. In 2015, Lygos, Inc. had produced malonic acid from biomass-derived sugar, which turned out to be cost-effective and eco-friendly as compared to traditional petroleum routes.

Brief Approach to Research

FMI will follow a modelling-based approach and triangulation methodology to estimate data covered in this report. A detailed market understanding and assessment of the nature, grade type and end uses of the product segments covered in the study is followed by carrying out a demand-side approach to estimate the sales of target segments, which is then cross-referenced with a supply-side assessment of value generated over a pre-defined period. The statistics and data are collected at a regional level and consolidated and synthesized at a global level to estimate the overall market sizes.

Key Data Points Covered in the Report

Some of the key data points covered in our report include:

- An overview of the Malonic acid market, including background and evolution

- Macroeconomic factors affecting the Malonic acid market and its potential

- Market dynamics, such as drivers, challenges and trends

- Detailed value chain analysis of the Malonic acid market

- The cost structure of the products and segments covered in the global Malonic acid market

- In-depth pricing analysis, by key segments, regions and by major Malonic acid market participants

- Analysis of supply and demand, such as top product producing and consuming geographies, product imports/exports, exchange of services and overall trade scenario in the global Malonic acid market

- Analysis of the global Malonic acid market structure, including a tier-wise categorization of key Malonic acid market participants

- Competitive landscape of the market, including detailed profiles of the top players in the Malonic acid market

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report covers exhaust analysis on:

- Market Segments

- Market Dynamics

- Market Size

- Supply & Demand

- Current Trends/Issues/Challenges

- Competition & Companies involved

- Technology

- Value Chain

Regional analysis includes:

- North America (U.S., Canada)

- Latin America (Mexico. Brazil)

- Western Europe (Germany, Italy, France, U.K, Spain)

- Eastern Europe (Poland, Russia)

- Asia Pacific (China, India, ASEAN, Australia & New Zealand)

- Japan

- Middle East and Africa (GCC Countries, S. Africa, Northern Africa)

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Request for Pre Book of Report: https://www.futuremarketinsights.com/checkout/6550

Global Malonic Acid Market: Segmentation

The global Malonic Acid market can be segmented on the basis of grade, function and end-use.

On the basis of grade, the global Malonic Acid market can be segmented as follows:

- Technical Grade

- Pharmaceutical Grade

On the basis of function, the global Malonic Acid market can be segmented as follows:

- Precursor

- API

- Additive

- Other

On the basis of end use, the global Malonic Acid market can be segmented as follows:

- Paint & Coating

- Polymer & Plastics

- Pharmaceutical

- Flavor & Fragrance

- Electronics

- Others

Report Highlights:

- Detailed overview of parent market

- Changing market dynamics in the industry

- In-depth market segmentation

- Historical, current, and projected market size in terms of volume and value

- Recent industry trends and developments

- Competitive landscape

- Strategies of key players and products offered

- Potential and niche segments, geographical regions exhibiting promising growth

- A neutral perspective on market performance

- Must-have information for market players to sustain and enhance their market footprint